The Team

Marc Gut

Vaishnavi Suresh Kumar

Alex Surasky-Ysasi

Mo Zhang

Muhammad Faizan Zafar

The Challenge

"To develop a product/service to assist the elderly in protecting their identity to avoid personal information loss that can, among other things, lead to their financial vulnerability."

Understanding Identity Theft

The Scale of the Problem

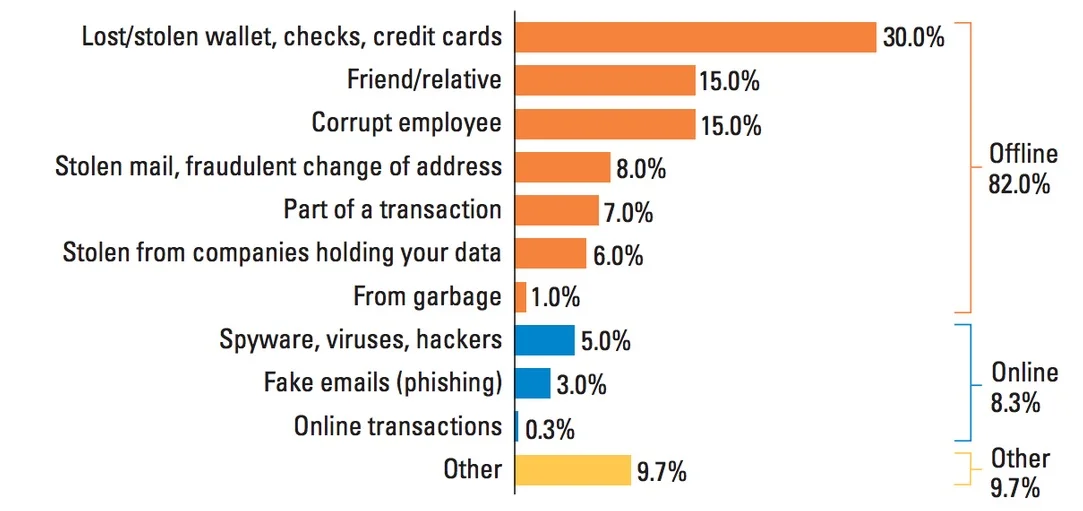

How Information is Stolen

Key Factors

SOCIAL

Aging Population

Assistive Facilities

Cognitive Abilities

Identity Verification

ECONOMIC

Financial Accounts

New Financial Services

Wallets, Purses

Cash vs. Plastic vs. Electronic Money

TECHNOLOGICAL

Biometric Data

Banking, Online/Local

Non-Standardized Services

Technology Gap

User Research & Insights

The team conducted surveys, focus groups and interviews with seniors, their caretakers, family members and financial institutions to understand their daily struggles when facing the issue of identity theft. From this research, we were able to develop a timeline of events and key in on the concerns and values of the different stakeholders. This led to insights that gave us the key product attributes we would need.

Stakeholders

Seniors

Concern: They don’t know when they have a problem and addressing it is a hassle.

Value: They wish to remain independent in their daily lives and feel secure in when performing financial transactions.

Family

Concern: Their elderly family member struggles to use new technology to secure information and simplify identity theft issues

Value: They want their family member to remain independent and feel secure. If the family member does become incapacitated they want it be easy to access all necessary information.

Financial Institutions

Concern: The elderly are often upset and hard to deal with when they have problems with accounts.

Value: Preventing identity theft resulting in financial savings through reduced fraud. They are able to maintain and grow their customer base by being trustworthy and easy to work with.

It became clear that if we could help seniors during the organization phase, then we could reduce the time it took to realize there was an issue and make it easier to respond.

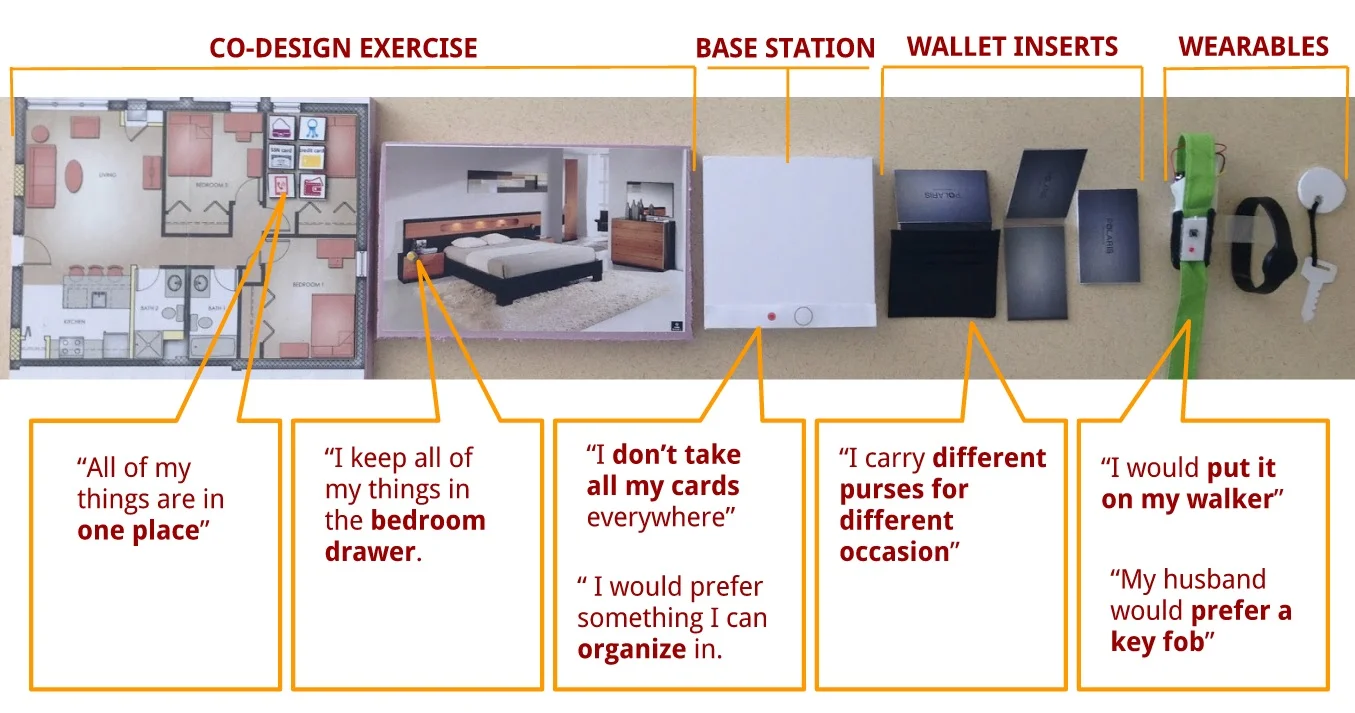

Concept Development & User Feedback

With the product attributes in hand the team began to develop ideas and come up with concepts. It quickly became clear that for the solution to fulfill all the attributes would take an approach that incorporated multiple pieces. As we developed a holistic system and the pieces, we reached back out to some of the seniors we had interviewed to get feedback and ensure we were on the right path.

Refined Concept & Business Model

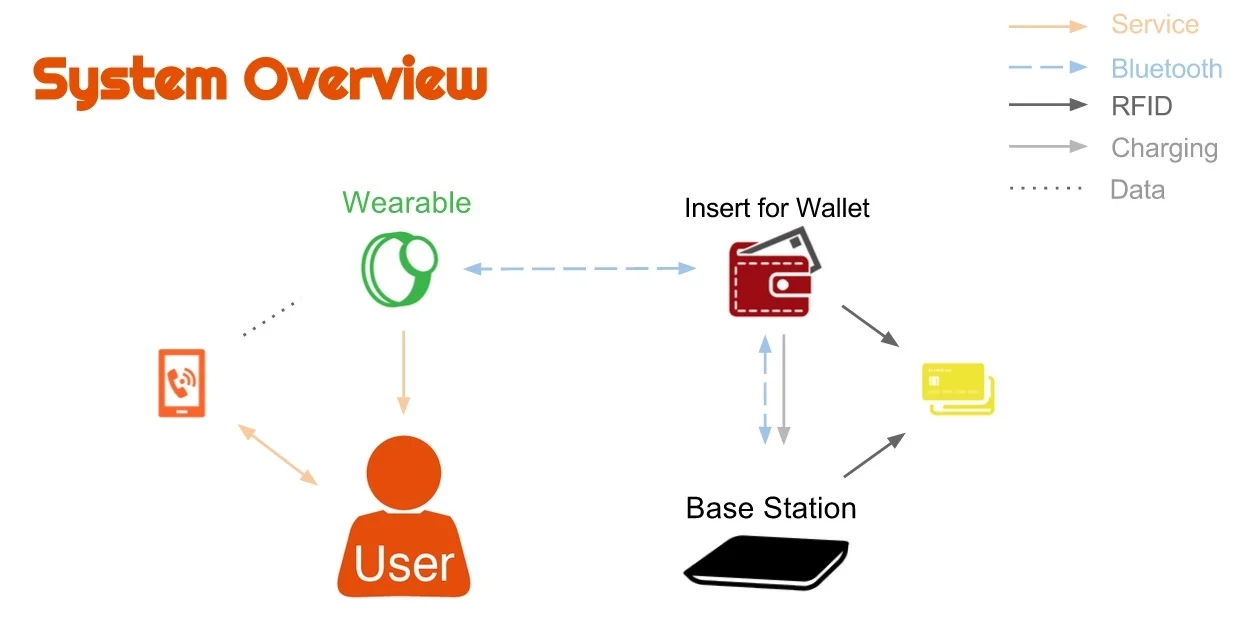

The team's final concept consisted of a wearable device, wallet insert that contained the main computing power, base station for charging in the home and a tiered service that could provide varying levels of support. The wearable device serves as a feedback unit that lets seniors know when their ID objects are in potentially compromised; it gets this information from the wallet insert which locates identification cards, credit cards with RFID technology. The insert also has GPS tracking and cellular communication, which can be activated if the seniors want to leverage additional features of the service. This service means that seniors get information about when and where their cards might have gone missing from a real person, rather than a screen or text, which they were extremely adamant about.

Base Station with inductive charging

Wallet Insert

Wearable device was modular, so that it could mimic a watch or serve as a key fob.

In order to fully empower seniors to choose how much assistance they want, which directly correlated to how much information they had to reveal the service, we developed a tiered concept, which would offer a subscription service that could provide varying levels of support. Ideally these products and this service would be offered by an existing insurance or financial institution, which already has the service center set up and access to an existing customer base to market to.

““You know I think that to the age group that you appeal to it’s going to make a very big difference because some of the people like myself who are here are quite old and don’t have one place that we put things in and they don’t remember where they put things so you have a problem right there.””